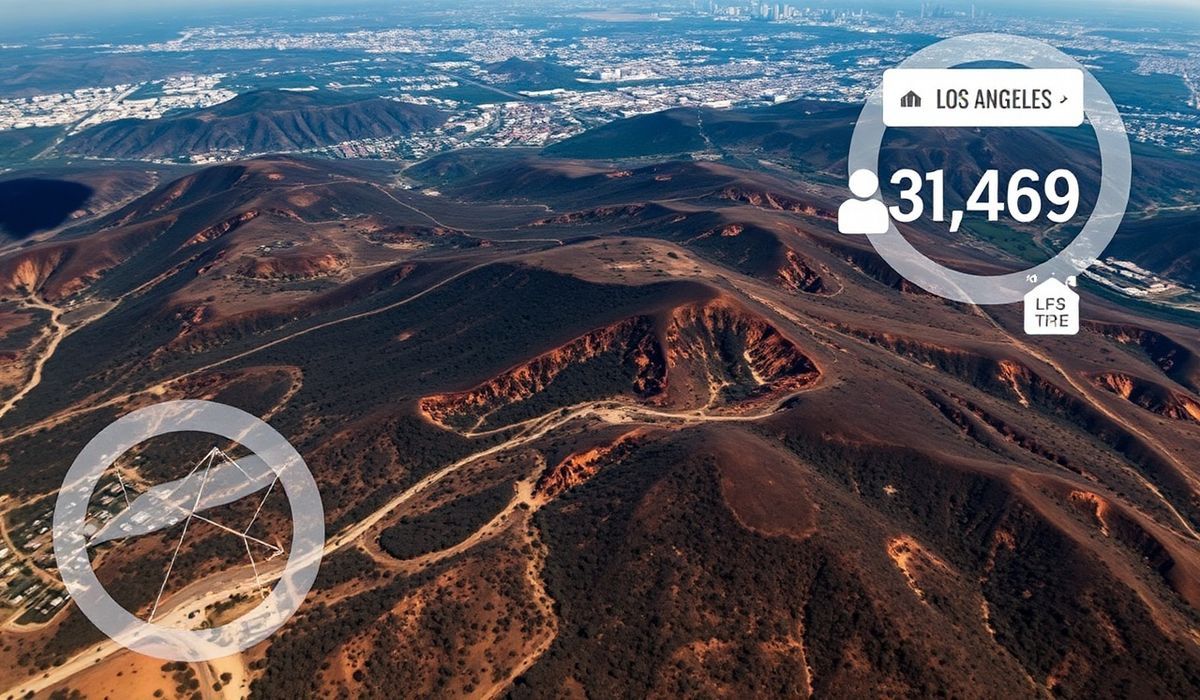

The California FAIR Plan, which serves as a last-resort insurance provider for high-risk areas, is grappling with $5 billion in wildfire exposure in Los Angeles alone. While the organization has $5.78 billion in reinsurance to manage these potential claims, the discrepancy highlights ongoing challenges in adequately preparing for and mitigating financial risks associated with worsening wildfire seasons.

Vero’s thoughts on the news:

The growing mismatch between risks in high-wildfire areas like Los Angeles and available financial buffers underscores the urgent need for stronger predictive tools and data-driven strategies. By leveraging advanced algorithms, machine learning models, and app-based platforms for public awareness, stakeholders could more effectively predict wildfire risks and allocate resources. Additionally, there’s an opportunity for tech-driven solutions to enhance insurance analytics, helping insurers like the FAIR Plan stay ahead of shifting environmental dynamics and protect vulnerable communities.

Source: FAIR Plan has $5 billion in LA wildfire exposure vs. $5.78 billion reinsurance – Fortune

Hash: 8c319063bf37834fb542045b0835f996779c4c723ee1c50d36f3e9764d152ad8