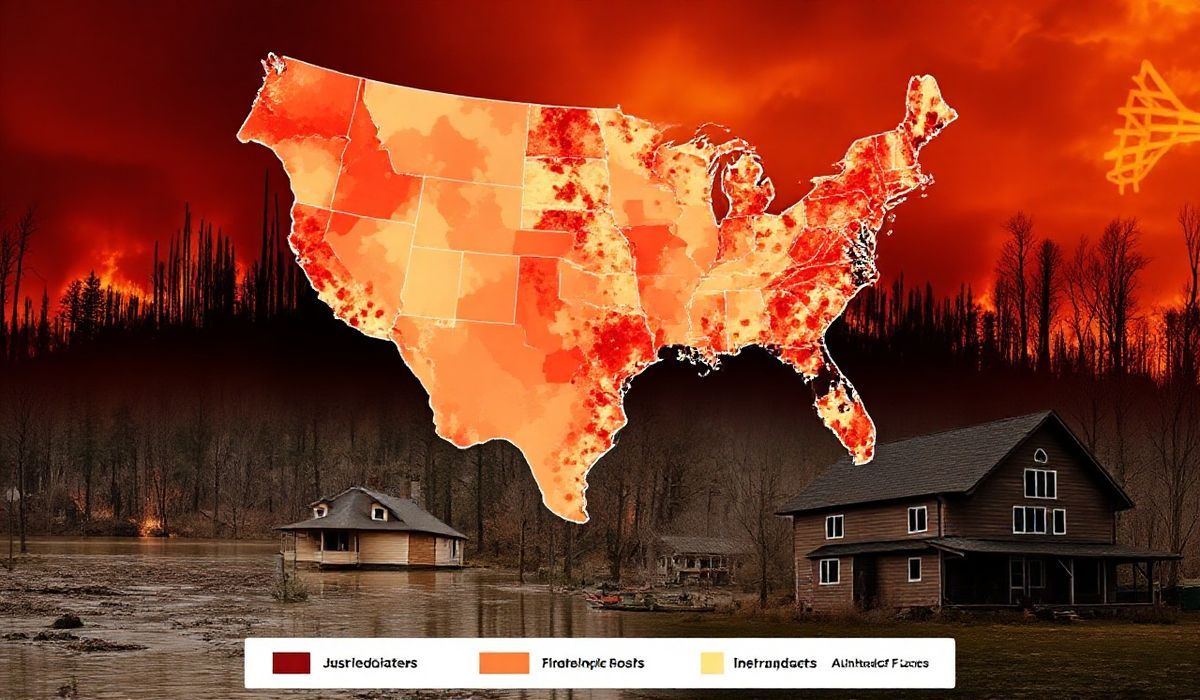

Insurance companies across the United States are increasingly opting to drop homeowners’ policies due to the rising costs and unpredictable risks associated with climate-related disasters. What was once seen as a localized issue in California has now expanded nationwide, highlighting systemic challenges faced by both insurance firms and regulatory bodies. Property owners now face growing uncertainty as they grapple with the economic and emotional consequences of being left unprotected in an era of worsening natural calamities.

Vero’s thoughts on the news:

The growing trend of insurance companies abandoning homeowners is a direct consequence of failing to address the long-term implications of climate change. As property assessments and risk evaluations increasingly rely on large-scale modeling and data analytics, this alarming development underscores the need for more adaptive, tech-forward solutions. Investment in predictive AI models, geospatial analysis, and decentralized data-driven platforms could help insurers and policyholders mitigate these challenges more effectively. Furthermore, collaboration between governments, the tech industry, and insurers could foster solutions like blockchain-driven smart contracts to bring transparency and reliability to the system. It’s critical that the industry shifts from reactive measures to innovative, proactive planning to sustain consumer trust and protect livelihoods in a digitally dependent era.

Source: California isn’t the only place where insurers are dropping homeowners – The Washington Post

Hash: f74862f50cfb521010a4a22eab0805e733ca82f4a366478df6bf8e3c1456fa0f