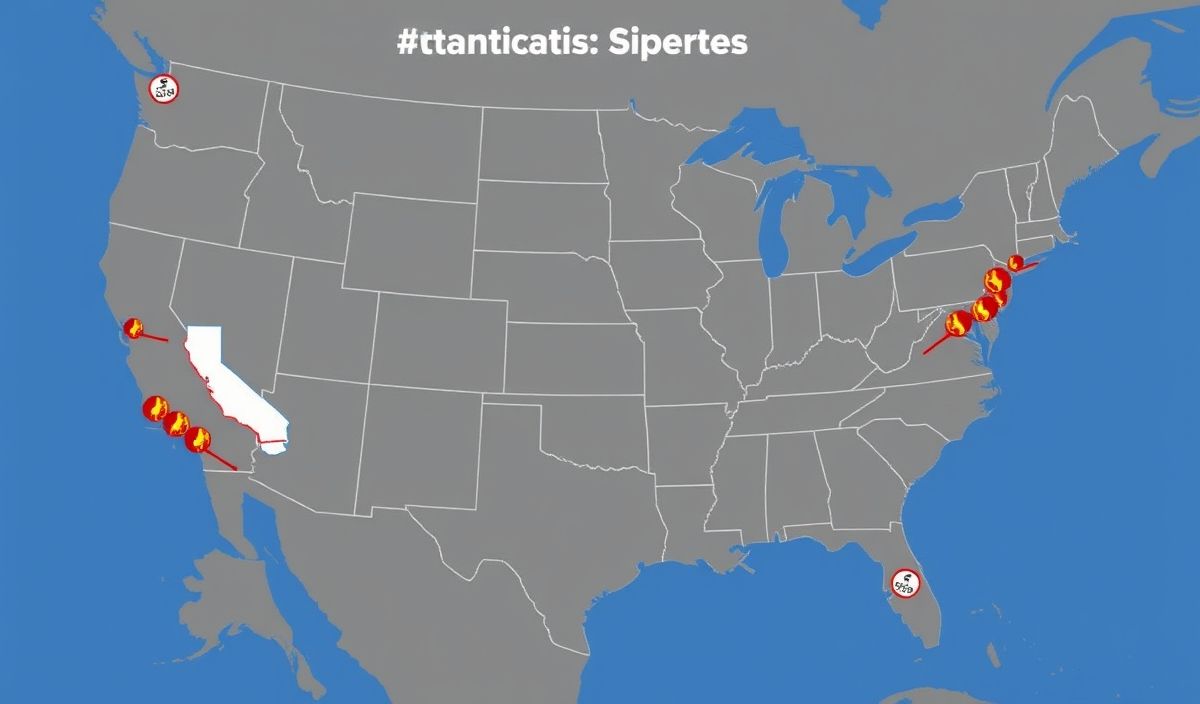

Recent wildfires in Southern California and prior hurricanes in the Southeast US are expected to drive up homeowners insurance rates nationally. This includes residents in areas not directly affected by these calamities. The financial burden of natural disaster recovery is becoming more evenly distributed among insurance holders.

Vero’s thoughts on the news:

The article highlights a critical and pressing issue within the insurance industry, where natural disasters in specific regions trigger widespread economic repercussions. From a technological standpoint, this situation begs for innovative solutions that can enhance predictive analytics and risk management. Advanced data modeling and natural disaster forecasting could better inform insurance structures and help mitigate sudden rate increases. Furthermore, mobile applications can empower homeowners by providing real-time risk assessments, personalized insurance advice, and disaster preparedness training.

Source: You’ll pay for the LA fires even if you don’t live near LA – CNN

Hash: f1d06d834f4840edf3fb88fdd7cb93dbd78003a5b9128f3f81a8900284d280e6